As cryptocurrency adoption continues to grow, so does the need for secure crypto storage solutions. Two of the most advanced options available today are hardware wallets and MPC (Multi-Party Computation) wallets. But when it comes to choosing between them, one crucial question arises: Are MPC wallets safer than hardware wallets? In this article, we’ll explore both technologies in depth, break down their security mechanisms, usability, and vulnerabilities that help you understand which one offers better protection for your digital assets. we aim to guide investors, institutions, and crypto enthusiasts in choosing the best wallet for their needs.

What Is a Hardware Wallet?

A hardware wallet is a physical device that securely stores your private keys offline in a secure chip, away from the internet and potential hackers. Often referred to as “cold storage.” By isolating keys from internet-connected devices, hardware wallets protect against malware and online hacks. They require physical access to initiate transactions, offering a high level of security for long-term storage.

Examples include Ledger Nano X, Trezor Model T, and SafePal. These devices are popular among long-term holders and security-conscious investors because they eliminate remote access to private keys, even if the computer or mobile device being used is compromised.

However, hardware wallets are not immune to vulnerabilities, including supply chain tampering, power glitch attacks, or physical theft. Despite these risks, their simplicity and proven track record make them a trusted choice for retail investors and hodlers.

Key Security Features:

- Cold storage (offline)

- PIN & passphrase protection

- Transaction verification on-device

- Open-source firmware (in some models)

- Immune to malware on host devices

What Is an MPC Wallet?

An MPC wallet is a type of non-custodial digital wallet that uses Multi-Party Computation (MPC) cryptographic technology to securely sign blockchain transactions without ever generating or storing a full private key in one place.

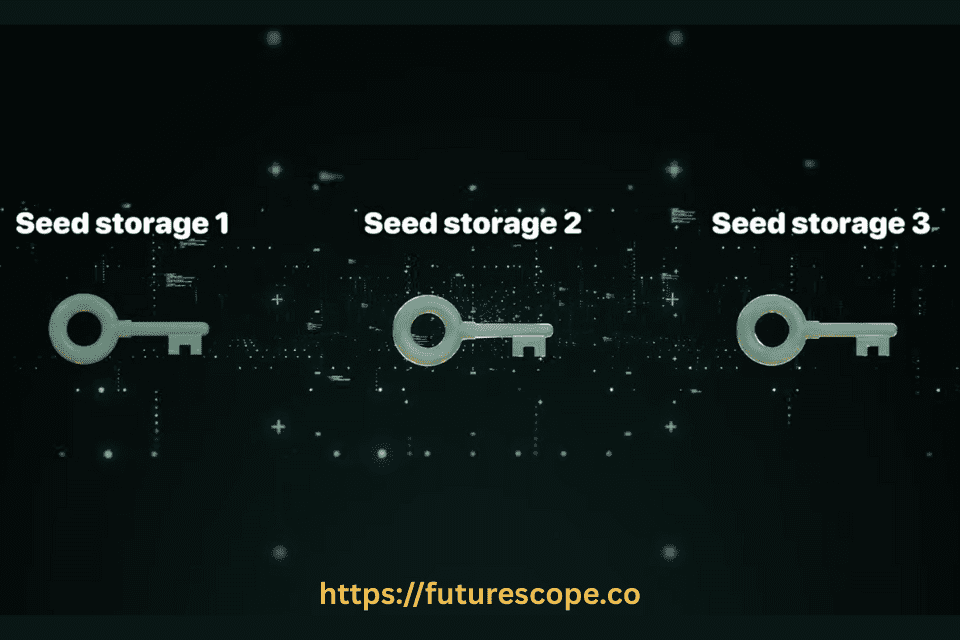

Unlike traditional wallets that rely on a single private key to authorize transactions, MPC wallets split the key into multiple parts (called key shares) and distribute them across different devices or locations. These distributed shares collaborate to approve transactions, ensuring that no single device or server ever holds the entire key, significantly reducing the risk of theft, hacking, or loss.

MPC (Multi-Party Computation) wallets are a cutting-edge software-based crypto custody solution that divides a private key into multiple encrypted shares. These shares are distributed across several parties (devices or servers) and never exist as a whole in one place.

Transactions are signed collaboratively without reconstructing the full key, offering non-custodial control with institutional-grade security.

Key Security Features:

- No single point of failure

- Threshold-based signing (e.g., 2-of-3)

- No private key ever fully exists

- Geo-distributed key shares

- Software-defined and backup-friendly

Popular providers include Fireblocks, Zengo, and Coinbase’s MPC tech for institutions.

How Do MPC Wallets Work?

At the core of an MPC wallet is threshold cryptography. Here’s how it works in simple terms:

- Private Key Splitting: The wallet splits the user’s private key into multiple cryptographic key shares.

- Distributed Signing: To sign a transaction, a predefined number of shares (e.g., 2 out of 3) must work together.

- No Single Point of Failure: Since the full private key is never reconstructed or stored, even if one device is compromised, the hacker can’t access the full key.

This decentralized approach to key management enhances both security and recoverability while maintaining non-custodial control, meaning users retain ownership of their assets without relying on third-party custodians.

MPC Wallets vs Hardware Wallets: Key Differences

| Feature | Hardware Wallet | MPC Wallet |

| Private Key Storage | Stored in physical device | Split into shares across devices/locations |

| Offline Protection | Yes (air-gapped) | Partially (depends on implementation) |

| Security Against Theft | High (unless physically stolen) | Very high (no full key exists anywhere) |

| Multi-device Support | Limited | Advanced (multi-location threshold signing) |

| Ease of Use | Requires physical device | Seamless with cloud/mobile integration |

| Institutional Suitability | Moderate | Excellent (ideal for enterprises) |

| Backup & Recovery | Needs secure recovery phrase | Multi-party or biometric recovery options |

Are MPC Wallets Safer Than Hardware Wallets?

MPC wallets are arguably safer in terms of resilience and redundancy, especially for organizations and advanced users. Because no full private key exists anywhere, there’s no single attack surface, making phishing, SIM swap, and seed phrase theft attacks far less effective.

However, hardware wallets still offer superior protection in offline, personal-use cases. They remain isolated from internet-based threats and are ideal for cold storage, long-term holdings, and self-custody scenarios where air-gapped security is preferred.

Which Should You Choose?

- Choose an MPC Wallet if:

You manage crypto assets with a team, require cloud/mobile integration, or need seamless multi-device security with no recovery phrases. - Choose a Hardware Wallet if:

You want self-sovereignty, offline cold storage, or to hold crypto long-term without relying on any external systems or software.

For even stronger security, many experts recommend using both: store long-term holdings on a hardware wallet and use an MPC wallet for active trading or team-based treasury management.

Usability and Convenience

Usability is a critical factor in wallet adoption. Hardware wallets, while secure, can be cumbersome for frequent transactions, requiring users to connect the device and input PINs. This makes them less ideal for active traders. MPC wallets, like Safeheron and ZenGo, streamline operations by enabling seamless, off-chain transaction signing. They also support gasless transactions and integration with DeFi platforms, enhancing user experience.

However, MPC wallets’ reliance on multiple parties or devices can introduce delays, especially in high-latency networks. For institutional users, MPC wallets offer customizable approval processes, making them ideal for complex operations, whereas hardware wallets cater to individuals prioritizing simplicity.

Cost and Accessibility

Cost is another consideration. Hardware wallets require a one-time purchase, typically ranging from $50 to $200, making them accessible to most users. MPC wallets, especially institutional solutions like Fireblocks, often operate on a subscription model, increasing costs for businesses.

However, consumer-grade MPC wallets like ZenGo are free to use, with optional premium features. Accessibility also varies: hardware wallets are widely available but require physical delivery, while MPC wallets can be set up instantly via apps. Both options cater to different budgets and needs, but MPC wallets’ scalability makes them more cost-effective for high-net-worth individuals and institutions.

Risks and Considerations

- Hardware wallets require secure physical handling. If lost or damaged without backup, funds may be inaccessible.

- MPC wallets, while secure, rely on complex infrastructure. Improper setup or weak distribution of shares may introduce vulnerabilities.

Future of Crypto Wallet Security

As blockchain technology evolves, MPC wallets are gaining traction due to their adaptability and robust security. Innovations like MPC-CMP algorithms and hybrid cold-storage models enhance their efficiency and resilience. Hardware wallets remain a staple for offline storage but face challenges in keeping pace with DeFi and Web3 demands.

However, multisig wallets, a precursor to MPC, are still praised for their transparency and battle-tested logic, suggesting a hybrid future where both technologies coexist. The choice ultimately hinges on balancing security, usability, and use case.

Popular MPC Wallet Providers

- Zengo: A mobile-first crypto wallet using MPC and facial biometrics—great for beginners.

- Fireblocks: A leading institutional-grade MPC wallet for enterprises and financial institutions.

- Coinbase Wallet MPC: Offers self-custody with enhanced security features for users.

- ZenGo X: Targets DeFi users with MPC keyless access and backup.

Final Verdict: Which Is Safer?

From a technical security perspective, MPC wallets provide a higher level of resilience and flexibility, especially in multi-user or institutional environments. Hardware wallets still reign supreme in offline self-custody scenarios where internet exposure must be minimized.

Ultimately, safety depends on how the wallet is used, user behavior, threat model, and level of expertise. For most users, combining both methods can offer the best balance between security, convenience, and control.