Historically, Bitcoin halving events have often been followed by bull markets. However, future market outcomes remain speculative and influenced by numerous factors.

The anticipation surrounding Bitcoin halving stems from the reduced supply of new bitcoins entering the market, which can lead to upward price pressure as demand may remain constant or increase. This event, occurring approximately every four years, represents a significant milestone within the cryptocurrency community.

It slashes the number of Bitcoin rewards that miners receive for adding new blocks to the blockchain, essentially cutting the rate of Bitcoin inflation in half. Investors and enthusiasts closely watch this phenomenon, speculating on its potential impact on the market. Amidst changing global economic conditions, regulatory developments, and technological advancements, the precise consequences of Bitcoin halving are difficult to predict with certainty. Nevertheless, its occurrence is a pivotal event that tends to stimulate widespread discussion and can significantly sway market sentiment.

The Phenomenon Of Bitcoin Halving

Bitcoin halving is like a digital magic trick. Every four years, it cuts the reward for mining Bitcoin in half. This event controls how many new bitcoins get made. Less reward means miners produce fewer bitcoins. Now, let’s dig deeper into this event and its power to shake the Bitcoin market.

How Halving Effect Bitcoin’s Supply?

Bitcoin’s code has a rule: after 210,000 blocks, cut the mining reward by 50%. This rule ensures only 21 million bitcoins will ever exist. Halving slows down the speed of new bitcoins entering the market, making existing ones potentially more valuable if demand stays steady or increases.

- Before halving: More bitcoins, miner rewards high.

- After halving: Fewer bitcoins, miner rewards low.

Historical Impact On Bitcoin’s Value

Let’s look at history. After past halvings, Bitcoin’s price often rose. Experts think supply drops make prices climb. When rewards fall, miners sell less. This can tighten supply if people keep wanting bitcoins.

| Event | Date | Effect |

| 1st Halving | 2012 | Price increased |

| 2nd Halving | 2016 | Price climbed higher |

| 3rd Halving | 2020 | Price soared |

| 4th Halving | 2024 | Price Bump |

Past patterns hint at a bull market post-halving. But remember, past success is not a sure bet for future results.

Market Speculations Pre And Post-halving

As Bitcoin edges closer to its next halving event, the community buzzes with anticipation. People wonder if history will repeat itself, triggering yet another bull market. This section delves into the speculations that swirl before and after the halving occurs.

Predictive Models For Crypto Markets

Financiers and tech buffs love to predict Bitcoin’s future. They create models to try and see what comes next. These models look at trends and try to guess where prices will go. Some famous models are stock-to-flow and time-series analysis. We will explore how each predicts the impact of halving.

- Stock-to-Flow Model: It looks at Bitcoin’s existing supply and how fast new coins come out.

- Time-Series Analysis: This dives into past price data to estimate future price changes.

Investor Sentiment And Halving Events

Investor mood alters with big events. The halving is a huge deal. It cuts new Bitcoin supply in half every four years. Buyers and sellers behave differently around these times. We’ll analyze how their moods shift and what it means for Bitcoin’s price.

| Event | Pre-Halving Sentiment | Post-Halving Sentiment |

|---|---|---|

| Halving | High hopes | Mixed reactions |

The table above helps us see the mood swing. Investors often feel optimistic before a halving, dreaming of price jumps. After the halving, some stay hopeful while others start to doubt.

Analyzing Past Trends In Halving Cycles

As Bitcoin enthusiasts and investors anticipate the next halving event, it’s crucial to look back at previous cycles. Past data can provide valuable insights. Understanding these trends helps investors predict possible outcomes.

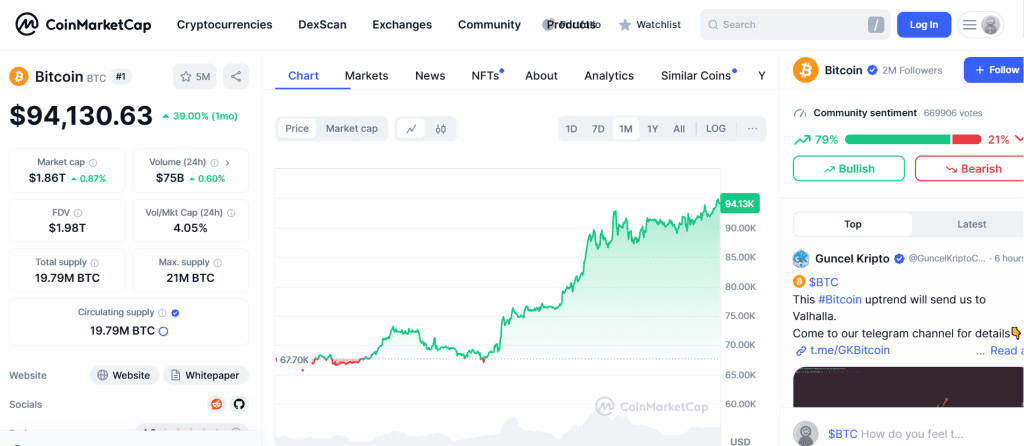

Price Fluctuations From Previous Halvings

Bitcoin has undergone halving events roughly every four years. Following these events, notable price jumps have been observed. These changes spark discussions and predictions.

- First Halving (2012): Bitcoin’s value increased exponentially a year later.

- Second Halving (2016): A similar surge occurred, reaching an all-time high in 2017.

- Third Halving (2020): Bitcoin saw another dramatic rise in value post-halving.

- Forth Halving (2024): Potentially creating upward pressure on prices due to increased scarcity as demand remains constant or rises.

While history is no guarantee of future results, these patterns offer guidance.

Long-term Effects On Bitcoin’s Economy

Halving impacts more than just short-term prices. It shapes Bitcoin’s long-term economic landscape.

| Aspect | Pre-Halving | Post-Halving |

|---|---|---|

| Miner Rewards | Higher rewards | Rewards reduced by 50% |

| Market Supply | Greater supply pressure | Lower supply pressure |

| Investor Interest | Varying levels | Typically increases |

The halving events strengthen the scarcity of Bitcoin. This encourages long-term holding and contributes to price stability over time.

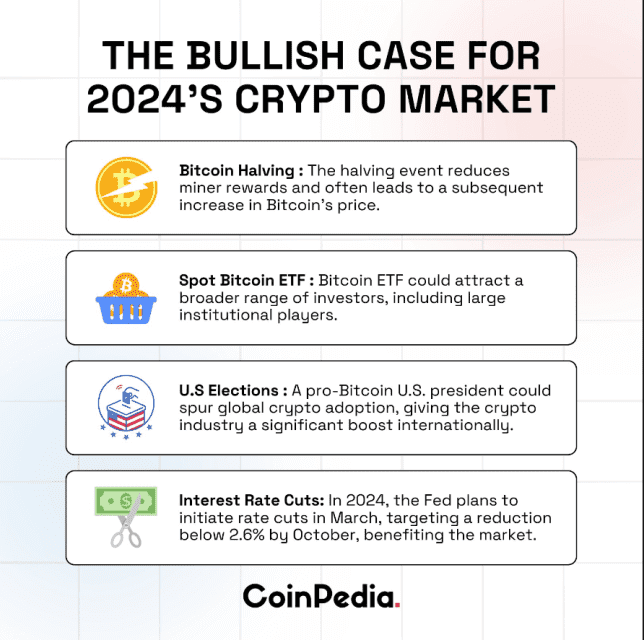

What Factors That Influence The Next Bull Market?

Everyone is talking about Bitcoin halving and its impact on the crypto market. Let’s dive into the factors that could sway the next bull run.

Bitcoin Halving (April 2024)

- The halving reduces the supply of new Bitcoins, increasing scarcity and potentially driving prices upward if demand remains strong.

U.S. Presidential Election (2024)

- If Donald Trump regains office, his administration’s approach to cryptocurrency regulation could play a role. Pro-crypto policies might encourage broader adoption, while stringent rules could create challenges.

Elon Musk’s Influence

- Elon Musk, a vocal supporter of Bitcoin and other cryptocurrencies, could reignite interest through his companies (e.g., Tesla) or public endorsements. His past tweets have significantly impacted Bitcoin’s market dynamics.

Trump’s Interest in Bitcoin

- While Trump has historically criticized Bitcoin, his stance may evolve, especially if economic or technological opportunities align with crypto integration in U.S. policy or business frameworks.

Geopolitical Events

- Events like currency crises or geopolitical instability may increase Bitcoin’s appeal as a decentralized, borderless asset.

External Economic Influences

External economic factors play a massive role in shaping the future of Bitcoin’s value. Consider these critical influences:

- Global economic health: When economies struggle, Bitcoin could shine.

- Stock market trends: Dips in traditional markets might push investors towards Bitcoin.

- Inflation rates: High inflation often turns eyes to Bitcoin as a hedge.

- Global events: Political stability and unrest can impact Bitcoin’s demand.

Technological Advancements In Blockchain

Blockchain tech is always growing. Consider how these advancements might fuel a bull market:

- Faster transactions: Quicker blockchain speeds could attract more users.

- Enhanced security: Stronger security measures may build investor confidence.

- Scalability solutions: Solving the scalability issue would be a green flag for mass adoption.

Regulatory Climate And Institutional Adoption

The stance of governments and big institutions is crucial. Let’s look at what could tip the scales:

| Regulatory Climate | Institutional Adoption |

|---|---|

| Clear laws can pave the path for stability. | Big players adding Bitcoin to their portfolios can signal trust. |

| Harsh regulations might scare off investors. | Corporate endorsement often invites a surge of individual investors. |

These elements, combined with the factors mentioned earlier, could amplify Bitcoin’s momentum during the next bull market.

Frequently Asked Questions?

Does Bull Run Happen After Bitcoin Halving?

Historically, Bitcoin has often experienced a bull run following a halving event, as reduced supply can lead to increased prices if demand remains steady or grows. However, past performance is not a guaranteed indicator of future results.

Is BTC Halving Bullish?

BTC halving often sparks bullish sentiment as it reduces the rate at which new bitcoins enter circulation, implying a potential supply decrease against steady or increasing demand.

What Will Happen After Bitcoin Halving In 2024?

After the 2024 Bitcoin halving, block rewards will drop from 6.25 BTC to 3.125 BTC, reducing new Bitcoin supply. This scarcity could drive prices higher if demand remains strong, as seen in previous halvings. Miners may face profitability challenges, leading to consolidation or reliance on price increases. Market sentiment is likely to be optimistic, potentially attracting more investors, while external factors like regulations, macroeconomic conditions, and institutional adoption will also influence outcomes.

Should I Buy Bitcoin Before Or After Halving?

Deciding to buy Bitcoin before or after halving depends on your investment strategy and risk tolerance. Market conditions can significantly change, so research current trends and consult a financial advisor.

How does the economy sanctions affect Bitcoin?

Economic sanctions can boost Bitcoin adoption as individuals and nations seek alternatives to traditional financial systems. Bitcoin’s decentralized nature allows users to bypass restrictions, enabling cross-border transactions without reliance on banks or intermediaries. This demand can increase Bitcoin’s value and usage, especially in sanctioned regions, but may also attract regulatory scrutiny and impact global perceptions of the cryptocurrency.

Is Russia using crypto to avoid sanctions?

Yes, Russia has explored using cryptocurrencies to bypass sanctions. Digital assets like Bitcoin and stablecoins allow cross-border transactions outside traditional banking systems, making them a potential tool for evading restrictions. However, large-scale use is limited by the transparency of blockchain transactions and increasing global regulatory scrutiny.

Conclusion

Predicting the future of Bitcoin is as challenging as it is thrilling. As the next halving event approaches, speculation surges. While historical patterns hint at potential growth, investing in cryptocurrency remains a personal risk-reward calculation. Thrive with knowledge, proceed with caution, and let time unveil the market’s response to Bitcoin’s halving.