The largest Bitcoin address holds approximately 288,000 BTC. As of early 2023, this equates to billions of US dollars.

Understanding the scope of wealth within the Bitcoin network begins with examining the most substantial addresses. The leading Bitcoin address, a symbol of pronounced digital wealth, signifies the potential for single entities to amass substantial cryptocurrency holdings. This specific address draws attention not only for its wealth but also as a case study in the distribution of Bitcoin assets.

As people enter the cryptocurrency domain, it’s crucial to grasp the scale of top players within this financial landscape. Despite the focus on decentralization, the existence of such a colossal address underlines the possible concentration of Bitcoin in the hands of a few. Individuals and investors examining the digital currency market often monitor these top addresses for insights into market movements and potential whale activities. This spotlight on the biggest Bitcoin address serves as a point of interest for those navigating the complexities of the cryptocurrency ecosystem.

Credit: www.quora.com

The Scale Of Bitcoin Wealth

The Scale of Bitcoin Wealth can seem almost mythical to many. The grandeur of Bitcoin’s economy is vast, with a landscape where digital fortunes rise and fall.

Individual addresses in the Bitcoin network hold wealth that rivals that of small countries. Exploring the largest Bitcoin addresses sheds light on the distribution of digital wealth and the players who dominate this virtual realm.

Breaking Down The Bitcoin Economy

The Bitcoin economy is a complex system. It involves millions of transactions and participants from across the globe. But how is this wealth distributed? Here’s a snapshot:

- Whale Addresses: These are the top-tier holders, owning vast amounts of Bitcoin.

- Exchanges: Platforms where users buy and sell Bitcoin, holding significant sums.

- Small-scale Wallets: The majority, holding fractions of Bitcoin.

The “whales” play a major role in the Bitcoin market, their actions influencing price movements.

The Giants: Analyzing The Largest BTC Addresses

The biggest Bitcoin address is an object of intrigue. This title often goes to a cryptocurrency exchange or a cold wallet.

Here’s what we know about these giants:

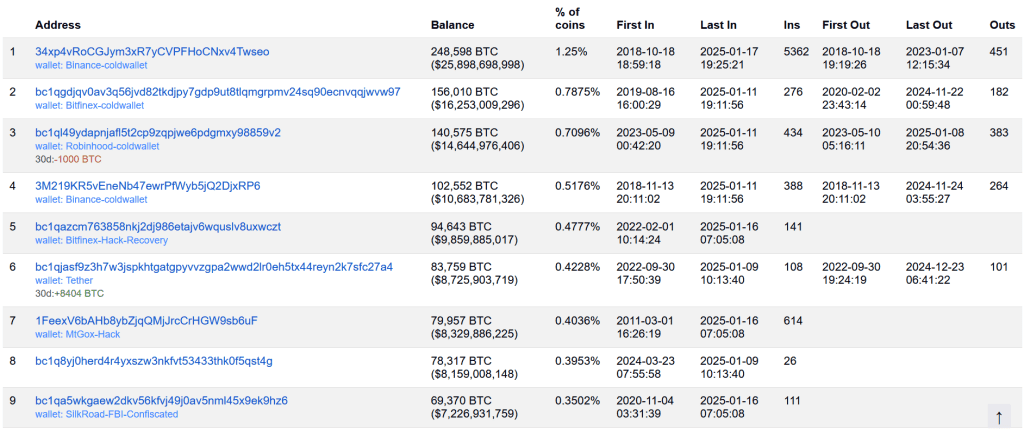

| Rank | BTC Address | Bitcoin Amount | Estimated Value (USD) |

|---|---|---|---|

| 1 | bc1q… | 141,452 BTC | $6 Billion+ |

| 2 | 3D2o… | 96,853 BTC | $4 Billion+ |

| 3 | 16ft… | 69,370 BTC | $2.9 Billion+ |

These amounts signify not just wealth, but also influence in the market.

Inside The Biggest Bitcoin Wallet

Ever wondered what lies within the vault of the largest Bitcoin wallet? Imagine a digital fortress holding an immense amount of digital gold. This fortress is the biggest Bitcoin address, a focus of fascination and intrigue within the cryptocurrency community. As Bitcoin’s value soars, the assets in its largest wallet become a topic of widespread speculation and amazement.

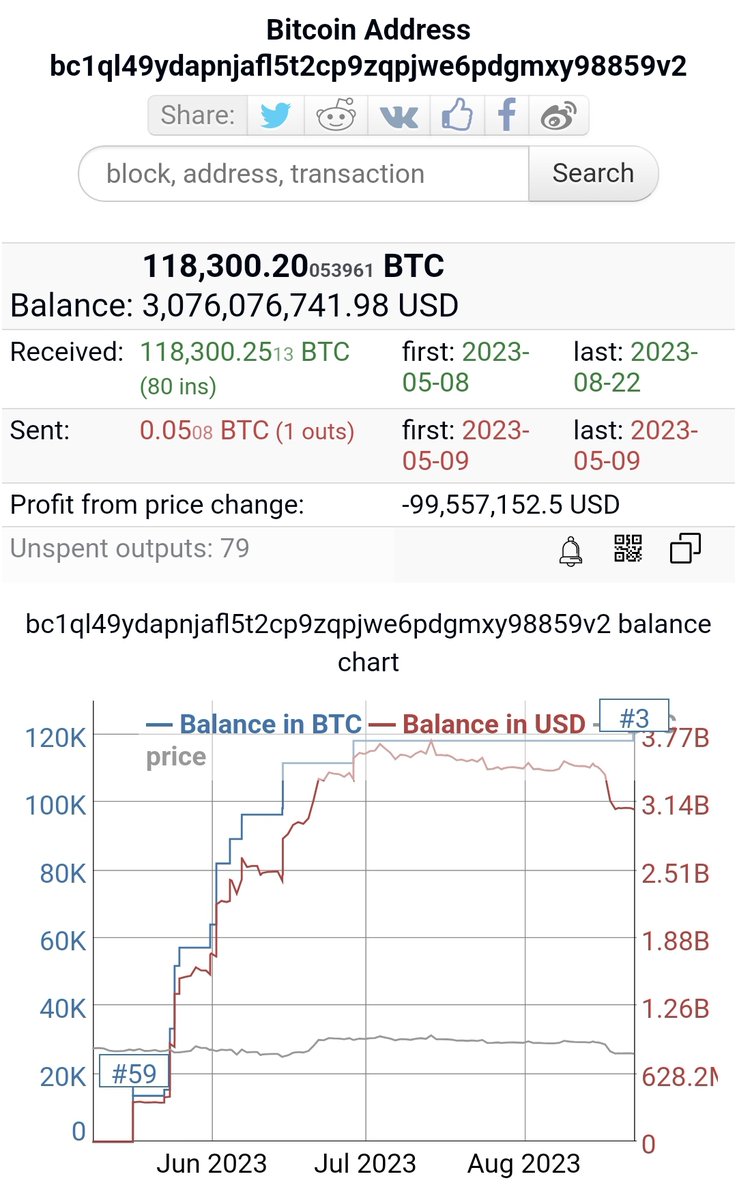

Snapshot: Wealth At The Top by 2025

The largest Bitcoin wallet is a testament to colossal digital wealth. It represents a significant portion of the circulating supply. The exact size can fluctuate, but at any given moment, it is a staggering sight. This Bitcoin behemoth dominates the landscape of cryptocurrency holdings, dwarfing other wallets by comparison.

As of the knowledge cutoff in early 2023, no single wallet eclipsed this giant. Its balance often equates to billions of USD. Here’s an approximate view:

| Bitcoin Address | Balance in BTC | Value in USD (approx.) |

|---|---|---|

| 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo | 248597.53642693 | $25938664464.81 |

Transactions And History Of The Largest Wallet

An air of mystery enshrouds the transactions linked to this mammoth Bitcoin address. The wallet’s history can be tracked, as all transactions on the Bitcoin network are public. Yet, the forces behind these movements remain concealed.

- First arrival of Bitcoins dates back many years.

- Regular inflows and outflows of funds can be observed.

- Occasional large transactions stun onlookers.

This wallet’s ledger mirrors a story of strategic collection and disbursement. Its moves can rattle markets or pass unnoticed like a whisper. Experts analyze every transaction, seeking insights into the market’s direction.

Who Holds The Keys?

The mystery of who controls the largest Bitcoin address ignites imaginations globally. This digital wallet holds a fortune. Picture a vault, filled with digital gold, and only a select few have the key. The biggest question remains: Who holds these keys?

Ownership Theories: Exchanges Vs. Individuals

Some believe a single wealthy individual owns the biggest Bitcoin address. Others think a crypto exchange controls it. Here’s a quick look at the theories:

- Individual Ownership: Could it be a crypto whale, slyly navigating the digital seas?

- Exchange Control: Perhaps it’s a digital fortress, where an exchange guards clients’ assets.

Each theory has merit. A hefty Bitcoin address could suggest powerful individual influence in the market. But practical signs hint at an exchange, centralizing numerous user funds for safety and liquidity.

The Anonymity Factor In Bitcoin Wealth

Bitcoin’s design favors anonymity. This veil keeps the biggest wallet owner’s identity a secret. Anonymity features:

- No names: Bitcoin transactions do not show personal details.

- Private keys: Owners use a secret code, not linked to their identity.

Anonymity shields owners from prying eyes. But it also sparks wild guesses and speculation in the crypto community.

Impact On The Bitcoin Ecosystem

The strength and influence of the largest Bitcoin address ripple throughout the entire cryptocurrency market. With a colossal sum of Bitcoin in a single wallet, each activity from this entity can shake market stability and raises numerous questions about security and control.

Market Influence Of Whale Accounts

Much attention sways towards the holders of these addresses, known as ‘whales.’ Whale accounts hold vast amounts of cryptocurrency, giving them significant leverage over market liquidity and price swings.

- Whales can create large buy or sell walls

- These actions can trigger price changes

- Smaller investors often react to these movements

Whale movements thus form critical market trend indicators not to be ignored.

Security Concerns For Massive Btc Addresses

Immense BTC addresses become lucrative targets for nefarious actors. The security of such wallets is paramount, as breaches could lead to substantial market disruption.

- Security breaches might erode investor confidence

- Theft from a large address could impact market stability

Strengthening wallet protection becomes an essential priority to safeguard the ecosystem against potential threats.

Frequently Asked Questions

What Is The Largest Bitcoin Wallet Address?

The largest Bitcoin wallet address can fluctuate as transactions occur, with no single address consistently holding this title. Addresses belonging to cryptocurrency exchanges often have significant balances. To find the current largest, refer to blockchain explorers that track Bitcoin wallet sizes.

Who Is The Highest Bitcoin Holder In The World?

The highest Bitcoin holder is often considered to be Satoshi Nakamoto, the cryptocurrency’s mysterious creator, owning approximately 1 million bitcoins. However, this has never been verified and remains speculative. Entities like governments and investment funds also hold significant amounts.

Who Owns 90% Of Bitcoin?

No single entity owns 90% of Bitcoin. Ownership is distributed across a global network of individual investors, companies, and miners.

How Many Wallets Have 1,000 Bitcoin?

As of my knowledge cutoff in early 2023, the exact number of wallets holding 1,000 Bitcoin is not static and can vary daily. Real-time data from blockchain explorers or analytical platforms provide the current count.

Conclusion

Exploring the vastness of the Bitcoin universe reveals surprising facts. The biggest Bitcoin wallet’s size demonstrates the immense wealth some investors hold. As cryptocurrency continues to evolve, these figures may grow even larger. Remember, staying informed is vital in the ever-changing world of digital currencies.

Stay curious and keep an eye on the biggest players in the Bitcoin space.