Bitcoin achieving a $100,000 valuation per coin is a possibility, but it remains speculative. Market trends, investor sentiment, and macroeconomic factors will ultimately determine its future value.

Discussing Bitcoin’s potential to reach $100,000 per coin sparks immense interest within the cryptocurrency community and beyond. Bitcoin’s history of volatile growth has showcased both dramatic spikes and significant drops. The digital currency has attracted investors who see its potential for high returns, despite the associated risks.

Global economic conditions, regulatory developments, and technological advancements play pivotal roles in influencing Bitcoin’s price trajectory. As the flagship cryptocurrency, Bitcoin has a track record of overcoming challenges and setting new highs, which keeps the $100,000 milestone within the realm of possibilities for enthusiasts and skeptics alike. Understanding Bitcoin’s market dynamics requires keeping abreast of an ever-evolving financial landscape where innovations and disruptions are commonplace.

The Growth Trajectory Of Bitcoin

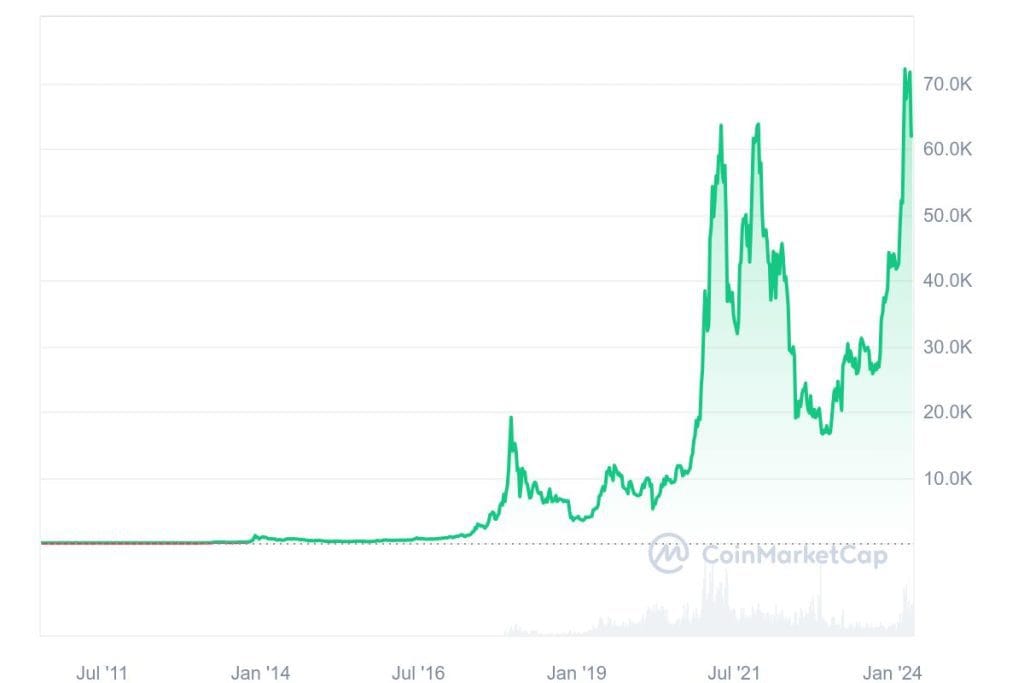

As we dive into the journey of Bitcoin, we can’t help but marvel at its rollercoaster of growth. From a novel idea to a currency that captures the world’s attention, Bitcoin’s path has been anything but dull. Questions buzz around its potential: Can Bitcoin reach the staggering price of $100,000 per coin? While the future is uncertain, understanding Bitcoin’s growth trajectory enlightens us on what might lie ahead.

Bitcoin’s ascent has marked several key milestones on its path. A journey that began with a value of less than a cent has punched through price ceilings that once seemed impossible.

| Year | Notable Price Milestone |

|---|---|

| 2009 | Introduction of Bitcoin, practically no monetary value |

| 2010 | First real-world transaction, valued at around $0.08 per coin |

| 2013 | Breaks the $100 threshold |

| 2017 | First boom to near $20,000 |

| 2021 | All-time high, crossing $60,000 |

| 2022 | Break down to $43000 |

| 2023 | Price fall to $28500 |

| 2024 | Price bull $73000 |

| Bitcoin Price Today (16th March, 2024) | As per COINMARKETCAP $62,032.49 |

These milestones showcase a tendency for rapid growth, spurring ongoing conversations about its next peak.

The wider acceptance of Bitcoin plays a crucial role in its growth trajectory. More businesses and investors are boarding the Bitcoin train, fueling its momentum.

- Institutional investment boosts confidence

- Payment systems integrate Bitcoin options

- Regulatory developments shape its future acceptance

Market sentiment has been a powerful force in the valuation of Bitcoin. This sentiment is driven by public opinion, media coverage, and global events. Positive news can send prices soaring, while negative news can spark swift downturns.

- Bullish market sentiment can lead to price surges

- Bearish sentiment may result in price corrections

As Bitcoin becomes more entrenched in finance and beyond, its adoption rate may continue to climb. This could set the stage for new peaks, possibly reaching that $100,000 milestone.

Factors Influencing Bitcoin Valuation of $100K milestone

Many experts debate if Bitcoin can hit the $100000 milestone. Understanding Bitcoin’s potential requires a look at key factors. These factors shape Bitcoin’s price. Let’s explore the main elements that impact Bitcoin valuation.

Supply And Demand Dynamics

Bitcoin’s value largely hinges on supply and demand. The digital currency’s built-in scarcity drives its value. With only 21 million Bitcoins to be mined, demand can outpace supply. As more people want Bitcoin, the price could skyrocket. Below are key supply and demand influencers:

- Halving events: Reduce Bitcoin reward for miners, impacting supply.

- User adoption: More users mean greater demand.

- Market sentiment: Public perception affects demand.

Institutional Investment And Regulation

Bitcoin’s journey to mainstream finance affects its value. Institutions investing in Bitcoin signal trust. This trust can boost Bitcoin’s price. Additionally, global regulations shape Bitcoin markets. Clear regulations can attract more investors, pushing prices up. Here’s a brief look at influences from institutions and regulations:

| Influence | Impact on Bitcoin |

|---|---|

| Big companies investing | Potential price increase |

| Regulatory clarity | Possible investor confidence boost |

| Governmental bans | Potential negative impact on price |

Bitcoin’s future remains exciting. A mix of market dynamics, institutional behaviors, and global policies guide its path to $100000.

Challenges To Reaching The $100K by 2024

The idea of Bitcoin reaching $100,000 captures the imagination of investors worldwide. Yet, several challenges loom on the horizon, potentially damping the fervor for such optimistic valuations. Unpacking these challenges reveals just how convoluted the path to this monumental milestone might be.

Market Volatility And Security Concerns

Bitcoin’s price swings wildly, often without warning. These swings can discourage new investors and worry seasoned ones. Investors find themselves on a rollercoaster of highs and lows, fueling a cautious approach to long-term projections.

Security is another major concern. High-profile heists and scams have led to losses in millions of dollars’ worth of Bitcoin. Fears of such incidents can lead to reduced investor confidence. This waning confidence directly impacts Bitcoin’s valuation.

Regulatory Hurdles And Competing Cryptocurrencies

Governments and financial institutions scrutinize Bitcoin. Worldwide, regulators implement rules that can hinder Bitcoin’s growth. These regulations aim to protect investors and maintain financial stability but can also limit Bitcoin’s reach and utility.

Bitcoin isn’t the only digital currency. Many other cryptocurrencies are vying for attention. They offer newer technologies and innovative features that can outpace Bitcoin. This competition divides the market and can slow the rate at which Bitcoin’s value increases.

Crypto Expert Predictions And Analysis

Debates about Bitcoin’s potential peak have captivated the market. With contrasting views, ‘Expert Predictions and Analysis’ delve into the extremes. Will Bitcoin soar or stumble? Here’s what experts suggest:

Bullish Forecasts From Industry Insiders

Optimism thrives among crypto enthusiasts. Many believe Bitcoin’s ascent to $100,000 is not just possible, but inevitable. Here are key factors driving their confidence:

- Adoption Rates: Increased acceptance from both the public and corporate spheres

- Halving Events: Reductions in Bitcoin block rewards potentially spiking demand

- Institutional Interest: Growing investments from major financial institutions as they embrace cryptocurrency

Industry leaders like Tim Draper stand by bullish predictions. Draper cites technology advancements and increasing distrust in traditional currency systems.

Skeptical Views From Economic Analysts

Yet, not all forecasts sing the same tune. Let’s explore the reasons behind the skepticism:

- Market Volatility: Bitcoin’s violent price fluctuations raise longevity concerns

- Regulatory Challenges: Potential government crackdowns could hinder growth

- Competition from Alternatives: The rise of other cryptocurrencies could dilute Bitcoin’s prominence

Economists like Nouriel Roubini highlight the risks. Roubini emphasizes the speculative nature and regulatory uncertainties surrounding Bitcoin.

| Predictor | Forecast |

|---|---|

| Industry Insiders | $100,000+ due to increased demand and tech growth |

| Economic Analysts | Below $100,000 owing to volatility and regulations |

Aligned with their respective views, insiders and analysts paint distinct pictures of Bitcoin’s path to $100,000. The divide is clear, but only time will tell which camp proves right.

Frequently Asked Questions Of Can Bitcoin Reach $100000 Per Coin?

Will Bitcoin Ever Hit $100,000?

Bitcoin’s future value is speculative, and reaching $100,000 cannot be guaranteed. Market volatility and unforeseen events make precise predictions challenging.

How High Can Bitcoin Realistically Go?

Bitcoin’s potential peak value is unpredictable as it hinges on market trends, adoption rates, and regulatory factors. It’s subject to extreme volatility, making its future price ceiling highly speculative.

What Is The Maximum Price Bitcoin Can Reach?

There is no definitive maximum price for Bitcoin as its value depends on market demand, investor sentiment, and regulatory changes. Predictions vary widely among experts and are speculative.

Can Bitcoin Reach $100,000 In 2024?

Bitcoin’s future value is speculative; predicting it to reach $100,000 by 2024 involves uncertainty. Market dynamics and global economic factors will influence its price trajectory. Investments in cryptocurrency always carry risk.

Conclusion

Predicting Bitcoin’s ascent to the $100,000 mark is a blend of financial insight and technological speculation. Market trends and investor behavior will ultimately dictate its trajectory. Amidst volatility and innovation, only time will tell if Bitcoin will soar to these historic heights or stabilize at lower levels.

Stay tuned to the cryptocurrency saga as it unfolds.