Yes, $100 in Bitcoin has the potential to make you rich due to the cryptocurrency’s volatility and high growth potential. Cryptocurrencies, especially Bitcoin, have seen significant price surges in the past, with some investors making substantial profits.

The decentralized nature of Bitcoin, combined with its limited supply and increasing demand, has created an environment where the price can soar. Consequently, investing $100 in Bitcoin might result in substantial returns if the cryptocurrency’s value continues to rise. However, it’s important to note that the cryptocurrency market is highly unpredictable and subject to significant risks.

Before investing, it is crucial to conduct thorough research, understand the market dynamics, and consider your risk tolerance.

Can $100 In Bitcoin Lead To Wealth?

Many people wonder if investing just $100 in Bitcoin can actually lead to wealth. In this blog post, we will explore the possibilities and analyze different scenarios to determine the potential for growing your investment. Let’s begin by understanding the historical growth of Bitcoin.

Understanding The Historical Growth Of Bitcoin

Bitcoin, the pioneer cryptocurrency, has undergone significant growth since its inception in 2009. Initially, its value was negligible, but over time, it has soared to unprecedented heights. This digital asset experienced rapid growth, attracting the attention of investors worldwide.

Bitcoin’s price has witnessed remarkable volatility, experiencing both significant ups and downs. This unpredictability has fueled both excitement and skepticism among investors. Nevertheless, it has proven to be a lucrative investment for many.

Exploring Past Success Stories

In order to determine the potential for wealth creation with a $100 investment in Bitcoin, it is essential to examine the success stories of early investors.

One notable example is the story of Erik Finman. At the tender age of 12, Finman bought $1,000 worth of Bitcoin. By the time he turned 18, his investment had grown to over $4 million. This exceptional story showcases the potential for massive returns on a relatively small investment.

Another success story is that of Kristoffer Koch, who purchased 5,000 Bitcoins for around $27 in 2009. These coins were essentially forgotten until 2013 when Koch discovered their value had skyrocketed, making him a millionaire overnight.

These success stories serve as inspiration and highlight the potential of Bitcoin to generate substantial wealth over time. Now, let’s analyze the scenarios of a $100 investment in Bitcoin.

Analyzing $100 Investment Scenarios

Before delving into various investment scenarios, it is crucial to note that the value of Bitcoin can fluctuate significantly in a short span of time. Hence, it is imperative to conduct thorough research and exercise caution when investing.

Here, we provide a few scenarios to give you an idea of the potential outcomes of a $100 investment in Bitcoin:

- Scenario 1: Bitcoin experiences another major bull run, similar to what we saw in 2017. In this case, your $100 investment could result in substantial profits, depending on the percentage increase in Bitcoin’s value.

- Scenario 2: Bitcoin continues its long-term growth trajectory, albeit at a more moderate pace. Over time, your $100 investment would likely appreciate, albeit at a slower rate compared to a bull run scenario.

- Scenario 3: Bitcoin remains relatively stable or experiences a downward trend. In this case, your $100 investment may not yield significant profits, but it could serve as a valuable learning experience for future investments.

These scenarios illustrate the range of possibilities that a $100 investment in Bitcoin can lead to. It is important to remember that every investment comes with a level of risk, and thorough research and consideration are crucial before making any financial decisions.

In conclusion, while a $100 investment in Bitcoin carries its uncertainties, it certainly has the potential to lead to wealth. By understanding Bitcoin’s historical growth, exploring past success stories, and analyzing various investment scenarios, you can make informed decisions to maximize the potential of your investment.

Factors Influencing Bitcoin’s Value

Bitcoin, the world’s first decentralized digital currency, has experienced a significant rise in popularity and value since its inception. While the potential of becoming rich with just $100 in Bitcoin may seem enticing, it is crucial to understand the factors that impact its value. Several key elements contribute to Bitcoin’s fluctuating market value, including market demand and supply dynamics, regulatory impacts on cryptocurrency, and technological advancements and adoption rates.

Market Demand And Supply Dynamics

The value of Bitcoin is directly influenced by the interplay between market demand and supply dynamics. Like any other tradable asset, Bitcoin faces fluctuations in its valuation due to the forces of supply and demand. When demand surpasses supply, the price of Bitcoin tends to rise, reflecting an increase in its market value. Conversely, if supply outpaces demand, the price tends to decline. This delicate balance between buyers and sellers in the market is a crucial driver of Bitcoin’s value.

Regulatory Impacts On Cryptocurrency

The regulatory landscape for cryptocurrencies plays a significant role in shaping Bitcoin’s value. Government policies and regulations can have both positive and negative effects on the cryptocurrency market. When countries adopt favorable regulations, such as recognizing Bitcoin as a legal form of payment or introducing crypto-friendly frameworks, it can increase adoption and investor confidence, thereby driving up the value of Bitcoin. Conversely, stricter regulations or bans imposed on cryptocurrencies can hamper their widespread use and potentially have a negative impact on Bitcoin’s value.

Technological Advancements And Adoption Rates

The pace of technological advancements and the level of adoption of Bitcoin also influence its value. As new technologies and developments emerge, Bitcoin may become more versatile, efficient, and scalable, leading to increased adoption and potential price appreciation. Additionally, the overall rate of acceptance and usage of Bitcoin among merchants, institutions, and the general public affects its value. The broader the adoption, the more demand there will be for Bitcoin, potentially driving its value higher.

Maximizing Gains With Limited Funds

If you’re a cryptocurrency enthusiast with limited funds, you might be wondering if you can turn $100 in Bitcoin into a significant investment. While it may seem like a small amount, the crypto market can be unpredictable, and with the right strategies, you can maximize your gains and potentially grow your $100 into something more substantial. In this blog post, we will explore three key strategies: dollar-cost averaging, timing the market, and diversification within the crypto space.

Dollar-cost Averaging With $100

When it comes to investing in any asset, including Bitcoin, it’s essential to adopt a disciplined approach, especially with limited funds. Dollar-cost averaging is a strategy that allows you to mitigate the risk of investing all your $100 at once, potentially avoiding market volatility.

The concept is simple: Instead of investing the entire $100 at once, you can divide it into smaller portions and spread out your purchases over time. For example:

| Date | Amount Invested | Bitcoin Price | Bitcoin Purchased |

|---|---|---|---|

| Week 1 | $20 | $10,000 | 0.002 BTC |

| Week 2 | $20 | $11,000 | 0.0018 BTC |

| Week 3 | $20 | $9,000 | 0.0022 BTC |

| Week 4 | $20 | $12,000 | 0.0017 BTC |

| Week 5 | $20 | $10,500 | 0.0019 BTC |

By breaking down your investment into smaller portions and spreading them out over time, you can take advantage of market fluctuations. This approach helps you avoid the temptation to time the market, as it focuses on the long-term potential of your investment rather than short-term price movements.

Timing The Market: Pitfalls And Opportunities

Attempting to time the market is a common pitfall for many investors. While it can lead to potentially high returns, it is also a risky strategy that can result in significant losses. Timing the market requires accurately predicting short-term price movements, which is incredibly challenging even for seasoned traders.

Instead of trying to time the market, it may be more prudent to focus on a long-term investment approach. By embracing dollar-cost averaging and holding onto your investment for extended periods, you can benefit from the historical growth trajectory of Bitcoin.

Diversification Within The Crypto Space, Ensuring

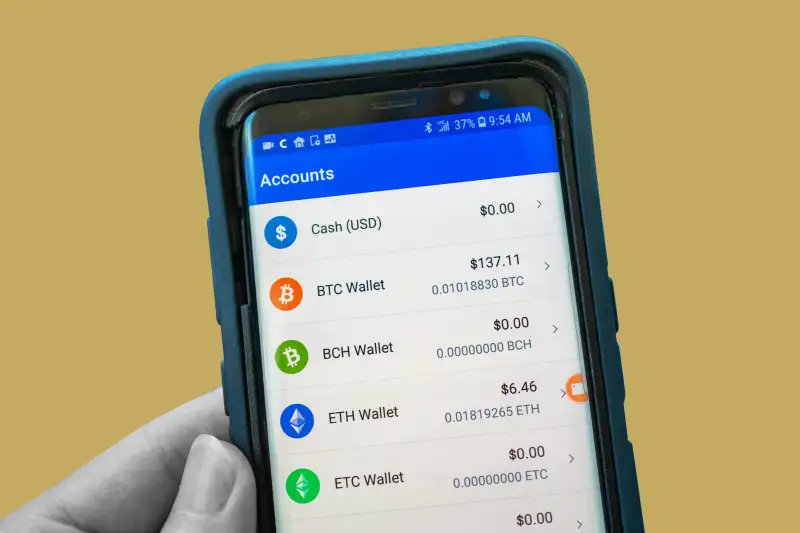

Diversification is another crucial strategy to minimize risk when investing in Bitcoin with limited funds. While Bitcoin is the most well-known cryptocurrency, the crypto market offers a wide range of other digital assets with varying growth potentials.

By allocating a portion of your $100 to different cryptocurrencies, you spread your risk across multiple assets, potentially maximizing your chances of significant gains. Ensure you conduct thorough research, assess the market performance, and carefully select a diversified portfolio that aligns with your risk appetite and investment goals.

In conclusion, while $100 may seem like a small amount, with the right strategies, you can maximize your gains and potentially grow your investment over time. Adopting dollar-cost averaging, avoiding the pitfalls of market timing, and diversifying within the crypto space can help you increase your chances of success. Remember, even small investments can make a significant impact when approached with discipline and a long-term mindset.

Managing Expectations And Risks

When it comes to investing in Bitcoin, the question on many people’s minds is, can $100 dollars make you rich? While the potential for significant returns exists, managing expectations and understanding the risks involved is crucial. In this post, we will delve into the volatility and high-risk nature of Bitcoin, the importance of a long-term vs short-term investment perspective, and the value of continued education in crypto investing.

Volatility And The High-risk Nature Of Bitcoin

One of the key aspects to consider when investing in Bitcoin is its volatility. Bitcoin is notorious for its price fluctuations, and this can be both a blessing and a curse. The price can skyrocket one day and plummet the next, making it a high-risk investment.

It’s important to understand that Bitcoin is still a relatively young asset compared to traditional investments like stocks or bonds. This lack of regulation and its nascent nature contribute to the volatility. While this volatility can lead to massive gains, it can also result in significant losses.

Therefore, it is crucial to approach Bitcoin with caution and only invest what you are prepared to lose. It’s advisable to diversify your portfolio rather than putting all your eggs in one basket. By spreading your investment across different assets, you can mitigate the risk associated with the highly volatile nature of Bitcoin.

Long-term Vs Short-term Investment Perspective

When it comes to investing in Bitcoin, having a long-term perspective is often the key to success. While some individuals have made quick gains through short-term trading, it’s important to note that this approach carries a higher level of risk.

By taking a long-term investment perspective, you are more likely to ride out the market’s ups and downs and potentially benefit from Bitcoin’s long-term growth. Many experts believe that Bitcoin still has a lot of room for growth, and by holding onto your investment for an extended period, you increase your chances of reaping the rewards.

However, this does not mean that short-term trading should be completely dismissed. Some individuals have managed to make profits by closely monitoring the market and taking advantage of short-term price movements. If you choose to engage in short-term trading, ensure you do your due diligence and have a solid understanding of technical analysis.

The Importance Of Continued Education In Crypto Investing

Given the rapidly evolving nature of the cryptocurrency market, continued education is vital for any investor. Staying informed about the latest trends, market updates, and regulatory developments is essential in managing risk and making informed investment decisions.

There are numerous resources available to enhance your knowledge of crypto investing. Online courses, webinars, forums, and informative websites can provide valuable insights and guidance. Additionally, engaging with the crypto community and joining discussion groups can help you stay up-to-date with the latest news and insights.

By dedicating time to educate yourself about cryptocurrencies and blockchain technology, you not only reduce the risks associated with investing but also position yourself for long-term success in the ever-changing crypto landscape.

Frequently Asked Questions For Can $100 Dollars In Bitcoin Make You Rich?

Can You Get Rich With $100 In Bitcoin?

Yes, it is possible to become wealthy with a $100 investment in Bitcoin. However, the cryptocurrency market is highly volatile, and profits are not guaranteed. It’s important to educate yourself, make smart investment decisions, and be prepared for potential risks.

Is Bitcoin A Good Long-term Investment?

Bitcoin has the potential to be a good long-term investment due to its limited supply and increasing mainstream acceptance. However, the cryptocurrency market is highly unpredictable, and it’s essential to conduct thorough research and consult with financial advisors before making any investment decisions.

How Can I Safely Invest In Bitcoin With $100?

To safely invest your $100 in Bitcoin, consider using reputable cryptocurrency exchanges or investment platforms. It is critical to choose a reliable platform that offers robust security measures, such as two-factor authentication, cold storage, and insurance coverage. Additionally, diversifying your investment and holding your assets in a secure wallet can help mitigate risks.

Conclusion

The potential of turning $100 into a substantial fortune solely via Bitcoin is slim. While the cryptocurrency market is volatile and unpredictable, there have been success stories. However, it is crucial to approach investments with caution and not solely rely on luck.

To increase the chances of wealth accumulation, diversify your portfolio and stay informed about market trends. With proper research and strategic decision-making, your investment in Bitcoin can yield profitable outcomes in the long term.