Cryptocurrency is digital or virtual money secured by cryptography algorithm. It facilitates secure, online transactions without relying on central authorities like banks.

Understanding cryptocurrency can seem hard, but it’s much like learning about a new digital tool. Cryptocurrencies operate on a technology called blockchain; think of it as a digital ledger that records all transactions across a network of computers. This technology ensures transactions are secure and that the currency cannot be counterfeited or double-spent.

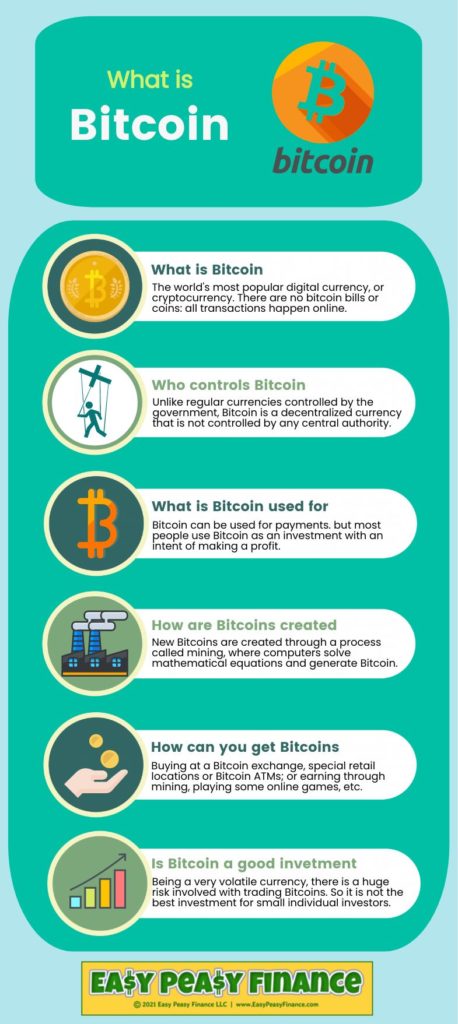

The most famous cryptocurrency is Bitcoin, which was the first and remains the most widely traded. As cryptocurrencies are decentralized, they offer a form of financial freedom from traditional banking systems, attracting a global audience looking to invest, trade, or simply use it as a form of payment. Embracing the future of finance means getting to grips with cryptocurrencies—their use, value, and potential to change our digital transaction landscape.

Explore Cryptocurrency

Many people hear the word cryptocurrency and think it’s very complex. It’s time to make it simple. Cryptocurrency is like digital cash that you can’t touch but can use online. Just as you keep money in your wallet, digital currency is kept in a digital wallet. It’s as simple as sharing a song online. Let’s break it down even more below!

The Basic Concept Of Digital Currency

Cryptocurrency is a type of money on your computer. Imagine having a piggy bank, but it’s on the internet. Instead of coins or notes, this piggy bank has digital coins. You can buy things with these coins. Nobody owns this money system, and it’s protected with special puzzles called cryptography. That’s why it’s called ‘crypto’-currency. Let’s list out what makes it special:

- It’s digital: No coins or notes, all online.

- It’s decentralized: No banks control it.

- It’s secure: Cryptography keeps it safe.

From Barter To Bitcoin: The Evolution Of Money

Long ago, people traded items they had for items they needed. This is called bartering. They swapped things like grain for meat. As time went on, coins and paper money came into use. With computers, digital transactions began. Now, Bitcoin and other cryptocurrencies are the latest step. It’s like virtual trading cards you can use to buy things or keep as they get more valuable.

| Time | Type of Exchange |

|---|---|

| Long Ago | Barter System – Swap Goods |

| Later | Coins & Paper Money – Physical Currency |

| Now | Bitcoin & Others – Digital Coins |

Each coin is a file in your digital wallet. You can transfer coins by sending them to someone else’s digital wallet. Every transfer is recorded in a public list called the blockchain. This helps keep everything open and secure.

Blockchain: The Backbone Of Crypto

Imagine a digital treasure chest where everyone can see what’s inside, but only you have the key. That’s like blockchain for crypto. It’s a magical book that keeps everyone’s secrets, but shows enough to stay honest. This book never lies and gets copied to friends’ homes worldwide. Let’s dive in and explore how this incredible technology shapes the world of digital money.

The Ledger Revolution

Blockchain changes how we track money. Long ago, people kept records in one place. Banks had their books. If those books vanished, so did your money. With blockchain, that story changes.

Everyone has a copy of this digital ledger. If one book gets lost, others are still safe. Your money isn’t in one spot, it’s in many places at once.

- A shared ledger: Everyone can see the same transactions.

- Immutable records: Once written, the information can’t be changed.

- Open to all: Anyone can join the network and use the ledger.

Security Through Decentralization

What if thieves can’t rob just one place? They have to rob the whole town! That’s like blockchain. It’s hard to cheat when the ledger is not in one place but everywhere.

Many computers hold pieces of the puzzle. To change one piece, you must change them all. This is nearly impossible! Your crypto stays safe because the network agrees on what’s true.

- Many eyes: Everyone watches, so it’s tough to sneak by.

- No single point of failure: With spread out records, risks drop.

- Trust in math, not people: Clever codes lock your crypto tight.

How To Acquiring Cryptocurrency?

Welcome to the world of cryptocurrency, where digital assets unlock new forms of investment and exchange. For beginners, starting the journey in acquiring cryptocurrency is a thrilling step. Simplified and secure methods make it possible for anyone to join this burgeoning financial landscape. Let’s walk through the fundamental steps to get you started: setting up a digital wallet and navigating crypto exchanges.

Setting Up A Digital Wallet

Before buying any cryptocurrency, a digital wallet is a must. This secure digital pocketbook is where you’ll store, send, and receive your digital currencies. Setting one up is your first port of call.

Types of Wallets:

- Software wallets: Accessible via computer or mobile apps.

- Hardware wallets: Physical devices, like USB drives, offering high security.

- Paper wallets: Printed QR codes representing your cryptocurrency.

Creating Your Wallet:

- Choose your wallet type based on your needs and security preference.

- Follow the chosen platform’s instructions to create your wallet.

- Ensure to save and secure your private keys or recovery phrases.

Navigating Crypto Exchanges

Once your wallet is set, the next step in acquiring cryptocurrency is through exchanges. Platforms like Coinbase and Binance act as marketplaces for buying, selling, and trading cryptocurrencies.

Steps to Use an Exchange:

- Register and verify your account for security.

- Select the right exchange comparing fees, ease of use, and supported coins.

- Fund your exchange account through bank transfers or credit cards.

- Link your digital wallet to the exchange for deposits and withdrawals.

- Browse the market and choose which cryptocurrencies to purchase.

Remember, research ensures a secure exchange experience, so review user feedback and platform security measures before diving in.

Transaction Method

Understanding the transaction mechanics of cryptocurrency is like learning a new digital language. It’s a crucial part of entering the crypto world. Below, let’s break this down into simple steps to help beginners grasp the basics of crypto transactions.

How To Send And Receive Crypto?

Sending and receiving crypto are fundamental actions for any user. It’s similar to online banking but with digital coins. Here’s how:

- Select a digital wallet to store your crypto.

- Generate a wallet address to receive funds.

- To send, enter the recipient’s address.

- Type the amount of crypto to transfer.

- Confirm the transaction with your wallet’s security.

Understanding Transaction Fees

Each time you send crypto, you’ll notice a transaction fee. This fee differs based on:

| Crypto Type | Network Demand | Transaction Size |

|---|---|---|

| Bitcoin, Ethereum, etc. | How busy the network is | Data size of your transaction |

The fee goes to network miners or validators. They process and secure transactions. A higher fee can mean a faster transaction.

Always check fees before sending. Some wallets offer a fee estimator to help.

Real-world Use Cases Of Cryptocurrency

Real-world use cases of cryptocurrency are expanding rapidly. Beyond the news stories and buzzwords, cryptocurrencies like Bitcoin and Ethereum are transforming how society views and uses money. Here’s how they’re taking action in the real world:

From Investment To Everyday Use

Initially viewed as an investment tool, cryptocurrencies are becoming part of everyday life. They offer users a new way to buy goods and services. Here are some ways people use digital currencies:

- Online Purchases: Many online retailers accept Bitcoin and other cryptocurrencies for payment.

- Travel: Some travel agencies and airlines let travelers book flights and hotels using crypto.

- Food and Beverage: Select cafes and restaurants welcome cryptocurrencies as a payment method.

- Retail: From tech stores to fashion, certain shops allow crypto payments for goods.

Crypto wallets, which store digital currencies, make these transactions possible. More and more businesses are enabling crypto payment options to accommodate customer preferences.

Impact On Global Finance

On a larger scale, cryptocurrencies are reshaping global finance. By providing an alternative to traditional banking, they offer several advantages:

| Feature | Advantage |

|---|---|

| Decentralized Control | Reduces dependency on central banks and financial institutions. |

| Global Access | Enables seamless cross-border transactions. |

| Lower Fees | Offers cheaper transaction costs compared to traditional banking. |

| Inclusivity | Provides banking opportunities for unbanked populations worldwide. |

The ability to move money globally, instantly, and without high fees is a game-changer. It is breaking down financial barriers and creating a more inclusive economy.

Frequently Asked Questions

What Is A Simple Way To Explain Crypto?

Cryptocurrency is a digital or virtual form of money, using cryptography for secure transactions and control over new units. It operates independently of a central bank.

What Do I Need To Know About Crypto As A Beginner?

Beginners should understand cryptocurrency basics, like blockchain technology and digital wallets. Research investment risks and regulatory changes. Only invest money you can afford to lose, and prioritize secure transactions. Stay informed with reputable sources to navigate the crypto market effectively.

What Is Cryptocurrency Explained For Dummies?

Cryptocurrency is digital money secured by cryptography, enabling secure, decentralized transactions. It operates on blockchain technology, independent of central banks.

How To Start Earning On Crypto For Dummies?

To start earning with crypto, learn the basics of Bitcoin, Ethereum, and blockchain. Use a reliable exchange like Coinbase or Binance, and start with a small investment you can afford to lose. Explore passive income options like staking, but prioritize security with wallets and two-factor authentication. Stay updated on crypto trends for smarter decisions. Start small, stay safe, and build gradually!

What Is The Downside Of Cryptocurrency?

Cryptocurrency can be volatile, leading to unpredictable market fluctuations. Security risks, including hacking and fraud, remain concerns. Limited mainstream acceptance and regulatory uncertainty pose challenges for users and investors.

Conclusion

Learning cryptocurrency starts with education. We’ve outlined the basics to help beginners grasp this digital frontier. Remember, learning is an ongoing journey, especially in the ever-evolving crypto space. Keep exploring, asking questions, and staying informed to confidently navigate the world of blockchain and digital currencies.